Anyone who has taken out a business loan for their company will likely have been asked to give a guarantee to the lender. A personal guarantee is generally required, even if the lender has taken security over all or certain assets of the company which is borrowing the monies to give the lender recourse to the directors or shareholders of the borrower.

It’s widely understood that giving a personal guarantee means the guarantor is guaranteeing repayment of the loan taken by the borrower, but what are the practical implications and what are the questions you should be asking before you sign on the dotted line?

-

When can a lender claim under a guarantee?

A guarantee in its truest sense is a secondary obligation, meaning that the guarantee is triggered once the primary obligation has not been satisfied i.e. the borrower has failed to repay the loan.

However, standard personal guarantees will include (1) a guarantee and (2) an indemnity. The indemnity is in fact a primary obligation. This means the lender does not need to prove that the borrower has not repaid the loan, before making a claim under the indemnity.

Have you agreed with the lender that they will only claim under the guarantee upon the occurrence of certain events? If this is the case, this should be expressly included in the personal guarantee.

-

What are you guaranteeing?

Are you guaranteeing the repayment of a “specific loan” or “all monies” owing to the lender? There is a big difference between the two. If you are guaranteeing a specific loan, your obligations are tied to sums owed under a specific loan agreement. If you guaranteeing all monies, your obligations, and your liability is much wider and would cover all monies, debts and liabilities of the borrower to the lender, on any account under present or future banking or credit facilities.

This is not always clear in the guarantee. For example, you may think the below wording only covers a specific loan agreement but it is in fact an all monies guarantee – notice the “and to the lender” wording at the end of this extract:

“Guaranteed Obligations” means all present and future payment obligations and liabilities of the Borrower due, owing or incurred under the Facility Agreement and to the Lender.

It may be that your business is taking out a specific loan which you intend to guarantee, but if the borrower also has other financing arrangements with the lender in place, say, an overdraft facility with the same lender, this would also be covered by the guarantee if you are guaranteeing on an all monies basis.

-

Have you capped your liability?

If you are a guarantor, it advisable to include a guarantee limit, capping the total amount recoverable under the personal guarantee. Ideally this would be stated as a maximum total amount either the same as the loan amount or less.

-

When does the guarantee terminate?

It’s not what you might think, as illustrated below:

- Resigning as a director – if a director guarantees the loans taken by the company in which they are a director and subsequently resigns as a director (or is removed), the personal guarantee does not terminate automatically unless the terms of it provide for that to happen. The personal guarantee means that any individual giving the guarantee has personal liability for the monies guaranteed. The personal guarantee is being given in your personal name, not in your capacity as a director. Some lenders may agree to a provision entitling the director to terminate the personal guarantee if they resign, but usually on condition that a replacement personal guarantee is given by another director

- Insolvency of the borrower – in an insolvency situation of the borrower, although the borrower would cease to exist once it has been liquidated, the debt remains outstanding and the personal guarantee remains enforceable against the guarantor. Indeed, this outcome is what the guarantee is designed to protect the lender against

- Guarantor’s death or incapacity – the death of an individual guarantor does not automatically discharge a personal guarantee. In general, the guarantor’s personal representatives step into the shoes of a deceased guarantor. The deceased guarantor’s estate will then become liable for any liabilities under the personal guarantee. This also means that the estate of the guarantor cannot be wound up until the personal guarantee is discharged, unless it can be terminated (see below). The effect of mental incapacity of the guarantor is the same as the effect of death

- Termination rights – Where there is no express termination clause in an all monies guarantee, the general rule is that it may be terminated by notice to the lender. You should ensure the personal guarantee includes a clause allowing you to terminate the guarantee by giving notice. Personal guarantees of specific liabilities should include a clause automatically terminating the personal guarantee when the guaranteed obligations have been discharged in full. Where there is no express termination clause in an all monies guarantee, the general rule is that you cannot terminate the guarantee. In addition, guarantors should be aware that terminating (also referred to as revocation or cancellation) a personal guarantee will not remove all liabilities totally. Pre-existing liabilities and those incurred during the notice period usually remain payable.

-

Can you get personal guarantee insurance?

It is a relatively new product in the insurance market but guarantors may be able to get personal guarantee insurance. There are only a few policies available in the market and the main thing to note with such insurance policies is that generally the policy cover will only kick in if the underlying borrower has started insolvency proceedings (and not before that point). You should ensure you review and get professional advice on the terms of the insurance cover.

-

Are you giving any warranties and representations?

A standard personal guarantee is likely to include various warranties and representations from the guarantor, for example, that the guarantor is a director of the borrower or that the guarantor has the capacity to give the personal guarantee.

You should carefully review the various warranties and representations to ensure that they are true, correct and accurate.

Watch out for when these warranties and representations are deemed to be given – are they given only effective from the date the personal guarantee is signed or do they repeat on each day that the personal guarantee is in force?

A further point to watch out for is how the personal guarantee crosses over with the loan agreement. If the loan agreement states that a breach of warranty under the personal guarantee is deemed to be an event of default under the loan agreement, if any of the warranties given under the personal guarantee are breached, this will crystalise an event of default under the loan agreement. An example is if you warrant that you are a director of the borrower under the personal guarantee, and then cease to be a director. That change would trigger a breach of warranty under the guarantee and an event of default under the loan agreement. It can be easy to trip up and there can be consequences under both agreements.

-

Will the lender enforce any security first?

Personal guarantees generally include an express provision stating that a lender is not obliged to enforce its security against the borrower before enforcing the guarantee.

Where you have agreed that the borrower will give security, do not assume that the lender will have to enforce its security before making a claim under the guarantee – it is usually at the lender’s sole discretion.

-

Do you have any existing financial arrangements in place?

Before entering into a personal guarantee, you should ensure that you do not have any existing financial arrangements in place which prohibit or restrict you from giving a personal guarantee. For example, do you have any existing personal guarantees, loans, mortgages?

-

Can the lender transfer its rights?

It is also worth watching out for the assignment / transfer rights of the lender.

If you have a good relationship with the lender and are comfortable with giving a guarantee based on the working relationship you have, but the lender subsequently assigns its rights under the guarantee to another party, you could find yourself liable to a different third party who you don’t know and may have a different approach to the enforcement of personal guarantees. Ideally, you’ll look to restrict the lender from transferring its rights and obligations without your prior written consent.

-

Costs and expenses

Whilst a guarantor will be aware of standard fees for a loan, there are further costs and expenses relating to the personal guarantee specifically.

Generally, the guarantor agrees to pay or reimburse the lender’s costs in preparing the guarantee as well as any steps or actions the lender needs to take to exercise or enforce its rights under the guarantee. You should ensure that the lender has obtained a fee quote for preparing the guarantee, and provided this to you so you are clear on what the costs will be to avoid a surprise bill for legal fees.

Most lenders will require that any individual guarantor gets confirmation from an independent solicitor that they have obtained independent legal advice on the terms of the personal guarantee. This advice is likely to be a cost which you will need to meet.

In summary, when you give a personal guarantee, you effectively become almost as responsible for the loan as the borrower is. It’s not easy to withdraw from this responsibility. So, it’s important to consider whether you could comfortably afford this loan should the worst happen and you are required to step in and make repayments for the borrower. Giving guarantees is not something to be undertaken lightly. It’s important to get proper advice beforehand and look to negotiate the best terms you can. Feel free to get in touch if this is something you’re considering now. We’re happy to help

Written Stephanie Donaldson

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Like what you see? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

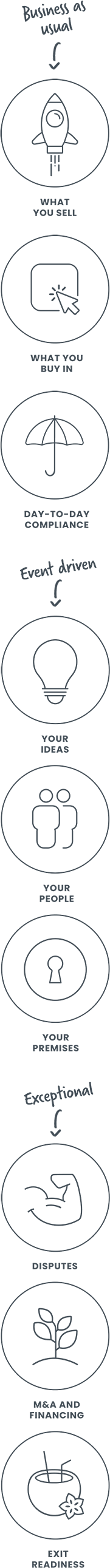

How we can help