Introduction

The UK is one the world’s leading international financial centres with a strong and open economy. However we are also vulnerable to economic crime. For example, the National Crime Agency estimates that money laundering alone costs the UK more than £100 billion a year. Anti-Money Laundering, or AML, is about tackling this head on. There are regulators at both the international and national level governing how to deal with the fight against financial crime. Our government has an economic crime plan which aims to make the UK the safest and most transparent place in the world to conduct financial business. Complying with the anti-money laundering regulations can be a complex process. In this article, we cover some basics. We explain what money laundering is and how to prevent your business from being used by criminals to launder proceeds of crime.

![]()

What is Money Laundering?

Simply put, money laundering is about concealing the origins of illegally obtained money. By passing this money through complex transfers and transactions, or through a series of businesses, the money is “cleaned” and made to appear legitimate.

Recent Posts

2025 Purpose Survey

– are we delivering?

Examples

There are plenty of examples of money laundering in the press.

For example, online estate agency Purplebricks was recently fined more than £260,000 by HM Revenue & Customs for violating money-laundering rules. HMRC, which is able to carry out spot checks, said Purplebricks was guilty of ‘failures in having the correct policies, controls and procedures, conducting due diligence and timing of verification’.

In 2019, Standard Chartered Bank was fined over a billion dollars by the UK and US authorities to settle allegations of poor money laundering controls and breaching sanctions against countries. The FCA gave examples where a customer was able to open an account by handing over 3m dirham (£500,000) in cash in a suitcase with little evidence that the source of cash was investigated.

However it’s worth bearing in mind that we tend only to hear about the biggest cases and because of the sums involved, it’s easy to feel distanced from the risks. But many smaller businesses are at risk of being used for money laundering activities and the billions of pounds laundered through the economy can be made of up smaller, high volume transactions. There are lots of examples of smaller businesses being caught by the regulations and it’s needs to be taken seriously because the penalties can be financial or in some cases, custodial.

How do I know if I’m subject to the AML regulations?

Many types of firms fall under the UK Money Laundering Regulations including:

- Credit institutions – for example lenders

- Financial institutions – for example banks

- Audit / accountants / tax firms

- Crypto-asset exchanges dealing in digital currencies

- Estate/Lettings Agents dealing in high monthly rents

- Casinos, Art Dealers, Auctioneers or any business that accepts or makes high value cash payments of €10,000 or more.

These industries all have slightly differing requirements. This is because they will have various levels of risk associated with them due to the services or products they offer and the customers they deal with. This is what’s known as the ‘risk-based’ approach.

Good Governance

Given the risks, it’s important to make sure that senior management takes responsibility for compliance with the UK Money Laundering Regulations. In order to do this effectively, they’ll need to appoint a qualified Money Laundering Reporting Officer, or MLRO. The MLRO will then carry out the functions necessary and regularly report back to senior management. If you are a smaller business, you may prefer to take on the role yourself but take expert advice when needed.

Risk Self-Assessment

If your business is subject to AML, the first step is to assess all areas of your business for financial crime risk. To do this, you need to carefully consider risk factors such as what products and services you offer, who your customers are, what countries you do business in and what delivery channels you use.

Without this, it’s really difficult to establish a baseline from which to plan.

Customer Due Diligence (CDD)

CDD is how you make sure your business isn’t transacting with criminals. You need to have adequate measures in place to identify a customer and verify they are who they say they are. For corporate customers, you must be able to identify who is behind the company. In other words, who controls the company or financially benefits from it.

Suspicious Activity

How would you recognise suspicious activity in your firm? Would you know what to do if you did see something suspicious? Under the UK Money Laundering Regulations, you must have processes that allow staff to recognise and appropriately act upon suspicions. This is important because that staff member, or senior management, could end up with a fine or even imprisonment in the case of serious failures or if they prejudice an investigation by tipping off the customer under suspicion of money laundering activities.

As above, given the risks, senior management and staff need to understand how to protect themselves and the business from prosecution. To do this, you need to ensure not just that adequate training is given but that your team really understands the training and can apply it to their real-world roles.

Accountability is a big part of this. You must keep adequate records of the training completed and be able to demonstrate that it’s effective. You also need to keep other AML records such as CDD, transactions and suspicious activity reports and these must be kept for a minimum of five years following the end of the customer relationship. It is also important to ensure Data Protection legislation is followed.

Tying it all together

Thinking about AML can be daunting, but the UK Money Laundering Regulations have been designed to make sure you don’t end up with policies and procedures that are overly burdensome. We recommend you begin with a thorough risk assessment, everything flows from there. When done well, a good compliance solution will mean your business and your team are fully informed and protected from enforcement action and they have done their bit in the fight against money laundering.

Written by Corinna Venturi

Financial Compliance Specialist at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Want to know more ? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

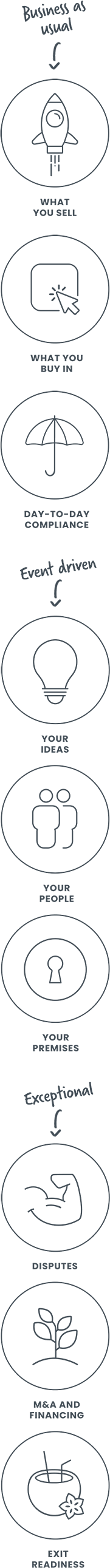

How we can help