Introduction: It takes two baby

Following on from our Lawskool article on Shareholder Agreements, and the important role a “pre-nup” shareholder agreement plays, this article explores what happens when a private limited company, with no separate shareholder agreement, has two shareholder directors who cannot agree. This is a reasonably common situation in SMEs which I’ve come across and advised on a number of times this year, as have my colleagues on the MIL team.

Below are some tips I’ve shared with clients which I hope will be useful to any SME.

-

Directors’ decisions

Have a look at your articles on how directors are to take decisions. Things to consider include:

- – Is a unanimous decision required for particular matters?

- – Is there a provision for the company only having one director?

- – How many votes does each director have?

- – Does the chairperson have a casting vote in the event of a deadlock?

- – In the event of a conflict, is there a mechanism for the quorum of the directors’ meeting being just one non-conflicted director?

- – Is a majority required (which clearly will not work with just two directors)?

-

Shareholders’ rights

Many companies have one class of shares with equal rights for shareholders, but creating different classes with different rights may enable the appointment of additional directors or increased voting rights

-

Chairperson’s role

It is very unlikely that a deadlock comes out of the blue. A strong board and chair should be able to pre-empt a disgruntled director, ensuring grievance and frustrations are openly aired and discussed before the relationship has materially broken down to such an extent that a deadlock situation arises

-

Employment contracts

How robust are your employment contracts? Do they work in conjunction with your articles (and shareholder agreement, if you have one)? To what extent do they anticipate the processes for what will happen in any given scenario?

They should also consider in advance, the possibility of a parting of the ways: what non-competes/restrictive covenants are in place; what are the confidentiality provisions to protect the business; is there a requirement to resign from a directorship if an employment relationship has ended?

-

Cost considerations

Both financial and emotional capital will be spent in seeking to untangle the deadlock

The only resolution may be the buy-out of the disgruntled co-shareholder/director by the company or the other shareholder(s). Emotions can run high, particularly when one party’s interests no longer appear to be aligned with the others and/or the business

There is potential for damaging publicity to the company and for your employees to be destabilised which may well affect their productivity and well-being, particularly if not addressed: employees, customers and key stakeholders may all need to be reassured if a co-founder publicly moves on

-

Avoiding court action

Although there are legal mechanisms under the Companies Acts which can be used to resolve deadlocked companies, these are expensive and time consuming and may not be available in every circumstance

Planning for an independent third party to be appointed to assist in decision making, or for the appointment of an expert third party to adjudicate on decision making, may be appropriate in the short term to ensure day-to-day decisions can still be taken. However, these measures are also costly, potentially disruptive to the efficient running of the business and do little to address the underlying fundamental problem directly. Which brings us back to our pre-nup…

-

Shareholders’ Agreement

Addressing these potential uncertainties head on in a shareholders agreement will provide clarity for all parties, and pre-emptively set out frameworks and mechanisms for resolving disputes between co-founders/shareholder directors

This can help to protect your business, so it continues to operate effectively when it does encounter those bumps in the road

Shareholder agreements are like a pre-nuptial for your business. Whilst it is not a legal requirement to have one, it makes dealing with any future falling out much easier to navigate

If you’d like to find out more on how we can help, please get in touch

Written Robin Hassan

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Like what you see? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

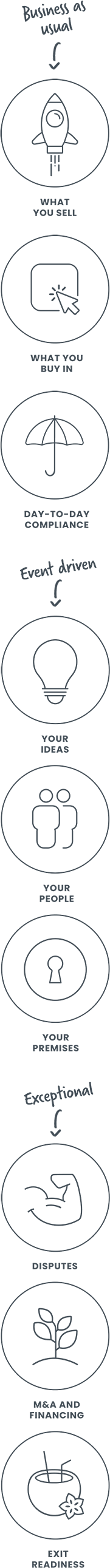

How we can help