Introduction

In construction, collaboration should drive success – but heavily amended contracts are doing the opposite. They keep pushing risk down the supply chain, leaving SMEs exposed to costs, shrinking margins, and even insurance gaps for risks they were never meant to carry. Many of these risks can’t be priced or planned for – they’re simply unknowns. This note explores 5 of those challenges and why it’s time for the industry to move from risk transfer to real risk management.

-

Site conditions risk

Most contracts now push the risk of site conditions and hidden defects straight onto the supply chain. The paperwork often sounds like every inch of the site has been thoroughly investigated – but let’s be honest, that’s rarely true. SMEs end up carrying risks they never had the chance to assess, leaving them exposed to unknown costs. Fairer contracts should reflect what the supply chain has actually been able to review – nothing more, nothing less.

What are some practical options for SMEs?

- • Review the paperwork only. If you haven’t been allowed on site before signing, make it clear your review is limited to the information provided

- • Add a basic visual check. If you’ve done a non-invasive site walkaround, spell out exactly what that involved – no more, no less.

- • Validate what you can. Where possible, include testing or validation of existing systems or plant to back up what’s on paper.

- • Use a Risk Matrix. Clearly set out which party is responsible for which site conditions – so everyone knows where they stand.

-

Uncapped liabilities

For SMEs in the supply chain, liability caps aren’t just a legal detail – they’re a lifeline. A clear cap helps define a manageable and quantifiable ‘worst case’ that can be mitigated by insurance and controlled risk planning. Uncapped liability might look like strong client protection, but in reality it can sink SMEs under the weight of a major claim – leaving everyone, including the client, worse off.

Set liability caps that match your role. Don’t accept high or unlimited liability for a limited piece of work. The level of risk you take on should reflect the scope of your involvement – nothing more, nothing less.

-

Blanket indemnities for breach of contract

An indemnity means agreeing to cover someone else’s loss – it can make you automatically liable, even if you’re not at fault. While certain indemnities, like those for third-party damage or intellectual property, are standard and reasonable, broad “catch-all” indemnities for breach of contract are a different story. These can expose SMEs to unforeseen and unquantifiable losses, including indirect or consequential damages far beyond their control.

Always check what the indemnity actually covers – and make sure it doesn’t extend your liability beyond what’s fair or insurable.

No indemnity? No problem — contract law already gives the other side a remedy if you’re in breach.

-

Specified Perils (Under JCT contracts defined as fire, lightning, explosion, storm, flood, escape of water, earthquake, riot, civil commotion etc)

More and more contracts are sneaking in clauses that leave SMEs on the hook for delays caused by so-called “Specified Perils.” In plain terms, that means the balance of risk keeps tipping further toward SMEs who are the ones left carrying the load when things go wrong. Clients often argue that if a “Specified Peril” happens because of a contractor’s or sub-contractor’s mistake – say, accidentally causing a fire and damaging a building – then the contractor or sub-contractor should take full responsibility and not get extra time. On the surface, that sounds fair. But in reality, it’s usually an uninsurable risk, meaning any losses would have to come straight from the sub-contractor’s pocket. For most SMEs, that kind of hit could be crippling – and if the liability is big enough, it could even push a business into insolvency.

A fairer approach is to let the contractor and sub-contractor have extra time for Specified Perils but not claim for loss and expense. That way, the risk is shared – the client covers their own delay costs, and the contractor and sub-contractor does the same.

-

Performance securities

SMEs are often asked for performance security to protect contractors and clients if it doesn’t deliver. These guarantees usually cover insolvency or serious performance failures that could lead to termination. These could be in the form of a performance bond, parent company guarantee or collateral warranty. However, often these documents go far beyond the original intention and create potential unquantifiable exposures. They can also often be used before all other contractual remedies have been exhausted – which is just not right!

Only give performance security where it’s fair and necessary. It’s there to manage genuine risk – not to boost the client’s credit position or pile on extra exposure you never agreed to take.

Conclusion

Passing down unquantified risk doesn’t make it disappear…it just pushes the problem further along the chain. Hidden issues will surface sooner or later, and when they do, SMEs are too often left carrying the cost. Redefining the norm starts with managing risk, not passing it on. By challenging unfair terms and insisting on balanced, transparent contracts, SMEs can protect their businesses, strengthen relationships, and help build a more sustainable and collaborative construction sector.

If you’re an SME in the construction sector coming up against some of these challenges, please feel free to reach out to us if you’d like some help.

Written Chris Judge

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Like what you see? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

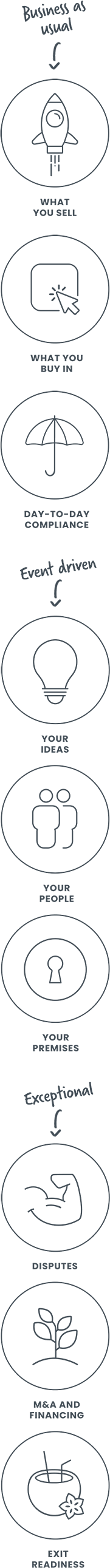

How we can help