Introduction – a costly clause

Welcome to My Inhouse Lawyer’s Anecdote series. These are tales from the front line. Things our team has come across, in the practice of law, which we are sure business leaders will want to know. The purpose is really about highlighting practical gems which you wouldn’t get from AI or a web search.

Desperate times, dangerous terms

It was a business in growth mode, needing a quick cash injection to cover operational costs and bridge to their next funding round. They found a lender willing to move fast. The paperwork? Dense, templated, and heavily in the lender’s favour. But time was tight. Legal review was skipped.

The loan agreement included a high base interest rate—not great, but manageable. What they didn’t appreciate was the sting in the tail: eye-watering default interest of over 30% per annum, triggered by delays in payment. This had been presented as a monthly rate which is perhaps why it wasn’t fully appreciated.

![]()

Default and demand

Inevitably, a late payment occurred. The lender pounced, issuing a formal notice of default and demanding immediate repayment, including the default interest.

The company was stunned. Their monthly liability had ballooned overnight, and they faced threats of enforcement proceedings. What felt like a short-term fix suddenly looked like a long-term liability.

Key issues

The agreement had been presented as non-negotiable and urgent. The borrower signed under commercial pressure without fully assessing the legal risks albeit with a confidence in its ability to make the repayments. Crucially, the punitive default rate and rigid enforcement mechanisms weren’t properly assessed or understood.

From a legal perspective, there were arguments around unconscionability and penalties. But these are complex, high-risk routes, with no guaranteed outcomes. It’s far better to avoid such terms in the first place.

What we did

We immediately assessed the legal enforceability of the default provisions and explored potential defences under unfair terms and penalty doctrine. At the same time, we opened dialogue with the lender, proposing a commercial restructure.

Through negotiation, we secured a reduction in the default rate, an extension of repayment terms, and a standstill on enforcement. It wasn’t ideal, but it bought the company breathing room to refinance on better terms.

Outcome

The business survived, but with scars. The loan repayment drained capital reserves and delayed growth plans. More importantly, it triggered a fundamental shift in how the company approached financial agreements for the better.

Practical gems

-

Fast doesn’t mean reckless

Even under pressure, take the time for legal review. Especially for finance documents, where the cost of missing something can have real business impact.

-

Default clauses matter

Always check the default interest rate and enforcement triggers even if you have confidence in paying… your business and market conditions may quickly change. If they seem excessive, push back….before signing!

-

Escalate early

If a problem arises, act quickly. Legal arguments around penalties or unfair terms may be available, but your best leverage often comes from early, commercial negotiation.

Moral of the tale

Short-term fixes can create long-term pain. Read loan terms carefully, understand the downside, and get advice before signing. Because when the lender calls in the loan, there’s no time left to negotiate.

If this is an area you’d like to discuss further, please feel free to get in touch

Written by Martin Davidson

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Want to know more ? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

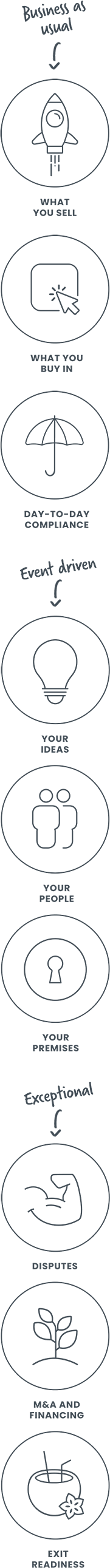

How we can help