Introduction

I often get asked this question and it’s a tricky one. How can I offer maximum help in the minimum amount of time, without knowing the whole picture? I go back to the basics:

- How should you set it up?

- How to finance it?

- How to run it?

Let’s see how we can best address these from legal perspectives.

![]()

Have a “prenup”

What do I mean by that? At the start of a new venture, we all feel super excited, optimistic and energetic and relationships are rosy amongst the founding team. I always encourage founders to ask themselves, what happens if things go pear-shaped, or people fall out. Have things documented (within reason) and hope you will never need to look at it again (because things ARE going well) – just like a prenup.

You should not feel awkward about raising the topic because any good business partner with a professional approach would appreciate an open conversation on what happens if things don’t go as planned.

Equity

I often see companies being set up and shares being issued with the agreed % amongst the founders right at the start. As with all start-ups, the ideas and products are constantly evolving, and each founder’s contribution may also evolve with it. In some cases, a founding team member may need to be swapped out for someone else in order to move the business forward due to skill set or change of direction for the individuals.

The high-profile lawsuit between the Facebook co-founders is an example of exactly this situation. From Mark Zuckerberg’s perspective, he was struggling with an original co-founder (Eduardo Saverin) who was no longer making any contribution to the business and in fact hindering the business growth because of his inaction while still holding significant voting rights. Whilst from Eduardo Saverin’s perspective, he was cut out of Facebook by the use of some “dirty legal tricks”.

Debt

It is also common for founders to put some initial funding into the company to get things off the ground. This is frequently done as a director’s loan. From the company’s perspective, you want some certainty that whoever puts the money in can’t just ask for it back at any time, and from the individual’s perspective, you want some form of recognition of the funding and an agreement on how and when it will be repaid. For example, if you are expecting repayment out of the next funding round, then think twice because this could jeopardise the SEIS status of the investment. Not being SEIS qualified would put most UK angel investors off.

IP

Intellectual property is also being created as products, software and/or marketing campaigns are being developed. The company won’t automatically own them unless there is a specific IP assignment agreement or the person creating it is an employee (which is often not the case for early-stage companies).

On all the above, each member of the founding team may have their own expectation as to who owns what, and what their contribution is worth. If nothing else, having a document in place also affords you an opportunity to have that conversation to ensure everyone is on the same page.

So, my advice – agree a reverse vesting schedule and/or milestones for the initial equity allocation to the founding team, make sure there is a robust compulsory share transfer mechanism in place (through the Articles or otherwise), get director loans documented and IP assignment in place, to avoid confusion and disputes.

Take a risk-weighted approach

When you start, you have limited resources and funding and you have a million things to do. It’s important to get things right from the start but it’s also important to prioritise the high risk and strategically important matters, and work out what can wait – and for how long before the risk is too high. Legal measures always need to be commensurate with the size and risk level of your business, and you can scale up as the business does.

For example, I have advised founders to hold off spending valuable cashflow on getting a state of the art shareholder agreement in place when they commissioned me to do so because based on their configuration, a well-structured founders agreement is sufficient (with the reverse vesting mentioned above), and when the next round of investors come in, they may well have their specific requirements and the shareholder agreement may have to change in any case.

On the other hand, corporate structure may be something worthy of early consideration especially when you have an international operation and are looking at strategic investors from overseas. One should always have an overall view on where your shareholders, core management team and development team are likely to be; where your revenue and cost centres are. For example, if you have the majority of your development team (and CTO) in Mumbai or Belfast, the sales and product team in the UK and senior management in the UK (other than the CTO), it’s useful to work through where the HoldCo should be and where all the IP should sit – that’s the entity the investors would want to put money in – so you have the optimal (simplest – but most cost and tax efficient) structure from the start, or as reasonably close as you can.

I’ve seen many companies spending too much money down the line on restructuring a legacy set-up that was cobbled together along the way which then jeopardises their invest-ability and eligibility in grants and so on.

Ownership & control

Don’t relinquish control too much too soon, but don’t hold onto it too dearly either.

There is no magic formula as to when is the best time to bring in a VC or when you should give up some of those precious decision rights and if so, what they should be.

Worth remembering, equity percentages are not always translated to proportionate voting rights and voting rights are different from veto rights (more on that in “Understanding a Term Sheet”) so there are ways to get decent investment without feeling like you’ve lost control of the company.

To sum up

Take a holistic view and be resourceful. Leverage accelerator, competitions and grants, and build a network of mentors, advisors, professionals, and entrepreneurs who have “been there and done that” with complementary skills to the founding team to help you to grow the business. Tap into the angel investor network and obtain advance assurance for SEIS/EIS. This way, you can preserve the cap table and control until an optimal point of the growth that the valuation could justify the dilution of equity and control and it is a strategically important juncture to bring in VC investment to get to the next level.

“A small piece of a big pie is better than a large piece of a small pie” is not always true depending on what size of the slice and what size of the pie we are talking about. It is right however, not to only look at the equity %, but also take into account the actual “control” dynamics, the veto rights and the valuation as a whole.

Written by Yinan Zhu

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Want to know more ? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

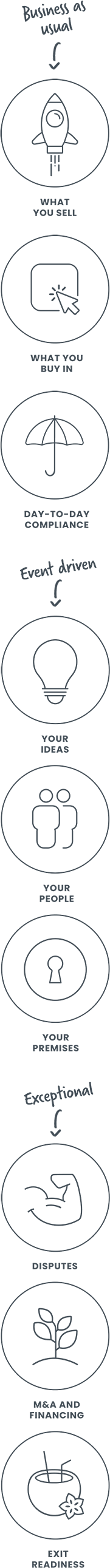

How we can help