Introduction

Wise words, but beware! Kenny’s crooning counsel comes with a warning if your business is facing financial difficulties and especially if your company enters the “twilight zone” of potential insolvency. If it does, your conduct as a director could later be closely scrutinised.

In normal trading circumstances, directors are under a duty to act in the best interests of the company and its shareholders – but be aware of the twilight zone shift, making directors responsible to have proper regard for the company’s creditors’ interests. The closer potential insolvency is, the greater is your responsibility as a director to protect the creditors’ interests. Be prepared to protect yourself too from potential personal liability for the company’s debts for wrongful trading or disqualification as a company director.

Walking or running away like Kenny, is not an option once your company enters the twilight zone – but rushing to place the company into some form of insolvency process (usually administration or liquidation) once the twilight zone looms, may similarly not be the right thing to do for the company or its creditors as explained below.

![]()

The Twilight Zone

The twilight zone is generally thought to occur when a company encounters financial difficulties or distress:

- Where its liabilities exceed its assets (the balance sheet basis)

- It can’t pay its debts as they fall due (the cash-flow basis), or indeed

- Where it is in imminent danger of either fate

Cash flow problems, late payments by customers, tightening of credit terms by suppliers, VAT or other tax payment arrears and repayment or refinancing pressure from lenders are common and often short-term issues faced by many companies – but when these issues are recurring and cumulative, a much more significant picture may emerge.

If you recognise these signs of financial adversity, now is the time to act. You must determine if you are in the twilight zone. If you are, you must think primarily about your creditors and treat their interests as paramount. A company moves out of the twilight zone and into insolvency when the directors know, or should know, there is no reasonable prospect of the company avoiding insolvent liquidation.

Consider these questions:

- Can we pay our creditors?

- Should we be incurring new debt?

- Should we be ordering goods or services we aren’t certain we can pay for?

- Should we continue to accept deposits from customers for orders we don’t know we can fulfil?

Once the line is crossed into the twilight zone, company directors face the additional risk of significant personal liability for wrongful trading. Worth bearing in mind that this can also affect shadow directors.

If a company continues to trade following the company’s shift into the twilight zone, the directors must act in the best interests of all creditors (including taking every step to minimise potential further losses to creditors) and have a reasonable belief that the company can avoid being insolvent.

What can directors do?

Carefully and realistically examine the company’s financial position and assess likely outcomes. If the position deteriorates, seek expert professional advice from accountants, lawyers and an insolvency practitioner to ensure that any decisions taken can withstand scrutiny.

Resigning as a director is generally not regarded well, doesn’t avoid the issue of wrongful trading and may be viewed as a dereliction of duty. There are none so wise as those out of pocket when a company is placed in insolvency. Creditors will be looking back with the benefit of hindsight and judging with certainty what the directors “coulda” or “shoulda” known and done to avoid the insolvency or mitigate their losses. Taking early professional advice is a key defence to help show that sensible steps were taken early on to minimise potential loss to the company’s creditors.

Although counter intuitive, it may be that the company should continue to trade even if it’s likely that ultimately, insolvent liquidation can’t be avoided. For example, if the company owns valuable intellectual property rights or other assets which will achieve a much higher value if sold on a going concern basis, and might lose that value on insolvency, it may well lead to a better outcome for creditors if the company continues to trade on a temporary basis to allow those rights to be marketed and sold. The difficulty will be judging how long to keep trading if a buyer can’t be found quickly.

Timing and judgement is everything. Kenny called it on knowing the importance of when to hold ‘em and when to fold ‘em.

Sense check

Overall, consider the following:

- Is there sufficient cash to pay debts as they fall due and for as long as necessary to enable the company to deal with balance sheet issues or finalise any restructuring process?

- If the company can’t pay its debts as they fall due, is there a realistic prospect of it being able to do so in the near future, and before any creditor takes steps to commence winding-up proceedings?

- Does the company have net assets or net liabilities on its balance sheet? Pay attention to contingent liabilities, which may not appear on the balance sheet at present, but which the company may have to meet in future.

- Are there any critical dates on which events might occur that will change the company’s circumstances, for better or worse?

- Is there any prospect of external funding?

- Is there interest in buying the company’s business?

- Could the company’s debts and liabilities be restructured?

Precautionary to do’s

Directors should pass scrutiny if they:

- Carefully analyse and keep the financial position (which includes considering cashflow forecasts and compliance with financial covenants) under persistent review

- Take professional advice early on

- Consider the potential impact on creditors of all decisions you take in the management of the company’s affairs, and

- Hold and minute regular board meetings, including recording the reasons for pursuing a particular course of action

Conclusion

If you think your company might be at risk of entering the twilight zone or you are already there, we can help. We recommend being proactive as the consequences of wrongful trading can be significant, including personal bankruptcy.

If you’d like to know more, please get in touch for more information about the general duties and liabilities of directors, good corporate governance practices and the additional risks and liabilities posed by potential or actual insolvency.

Written by Kelli Read

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Want to know more ? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

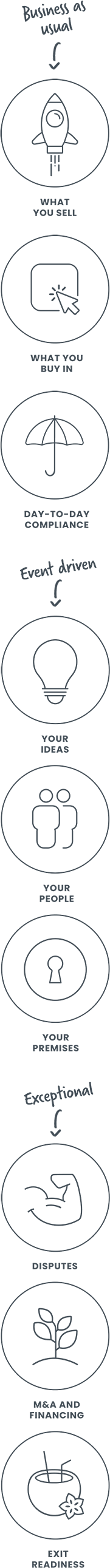

How we can help