Introduction

Employee ownership is becoming increasingly popular for UK organisations. Whether considering a management exit, succession planning, incentivisation and retention models or simply seeking to give employees some “skin in the game” for the cultural benefits that it can bring, employee share ownership can be an extremely effective tool. There are a number of different structural options and mechanisms when considering this. This article considers some of the options available.

While not directly addressed in this article, it goes without saying that tax is an extremely important factor that should be borne in mind when considering these structures, both for the organisation and for the employees and it is essential to seek appropriate tax advice.

![]()

Direct and indirect ownership

Generally speaking, employees can own shares in their employer either directly (i.e. when shares or options are held by employees individually), or indirectly, (i.e. when shares are held in a trust for the benefit of either a specific group or all of an organisation’s employees).

The benefits of direct ownership include giving employees the greatest sense of engagement in the company and potentially dividend participation. Direct ownership is particularly helpful when you are looking specifically at issues of employee retention although if you are considering direct ownership, you might wish to also consider what happens if an employee leaves the company and ensure that appropriate mechanisms are included to address such circumstances.

Direct ownership can be implemented by way of the company selling or gifting shares to employees and tax efficient schemes are available (such as Share Incentive Plans or “SIPs”). Growth Shares are often used as part of direct employee ownership structures to give employees a relatively low buy-in value coupled with the upside of sharing in any value-appreciation of those shares, for example, when specific milestones are met and/or valuation thresholds reached.

Indirect ownership by contrast offers an opportunity for a much larger number of employees to participate. It is also attractive from an administrative perspective for companies – the share capital of the company will continue to be held by a trust and employees joining and leaving employment will not require additional paperwork. Employee Ownership Trusts (EOTs) are currently among the most popular indirect ownership structures which, as well as being advantageous from a tax perspective, are helpful when considering succession planning whilst seeking to keep the status quo in the near term. The primary thing to understand about an EOT is that it involves transferring ownership of a controlling interest of a company into a specifically established trust and consequently, will result in a loss of control for the founding shareholders.

The above said, the choice is not binary and direct and indirect models are not mutual exclusive: a hybrid model can be adopted which allows, by way of example, an organisation to offer options alongside becoming an EOT.

Shares or share options?

Put simply, the difference between shares and share options is flexibility. Shares entitle an employee to be named on the register of members from the date of issue or transfer whereas options do not. While an option can be granted on day 1 as part of an employee’s incentivisation package, vesting can take place over a period of time (or to reflect length of service of an employee) and can be structured to automatically lapse on an employee leaving employment. By contrast, forfeited shares of a departing employee would need to be reflected on the register of members. Tax-efficient schemes such as EMI (Enterprise Management Incentives) and SIPs (Share incentive Plans) are available for both options.

Employee ownership trust (EOT) or Employee benefit trust (EBT)?

Both the EOT and the EBT are types of trust that are set up to allow shares in the company to be held indirectly for the employees of the company. However, the key difference between the two is that the EOT is a vehicle set up to allow an organisation to become ‘employee-owned’ whereas an EBT is more flexible. Another difference is that an EOT is established for the benefit of all employees of the company or group (albeit employees with less than 12 months continuous service may be excluded). By contrast, an EBT can be set up to benefit for a specific group of employees. This can be helpful when looking to incentivise a group of employees (senior members of the team, for example) but without moving into direct ownership structure. EOTs are generally more rigid and require 51% or more of the share capital of the organisation to be held by the trust.

Employees vs consultants/advisors

Many smaller companies are keen to reward not only their employees but members of the team who are working as consultants or advisors. As the name would suggest, non-employees cannot benefit from the indirect EOT or EBT structures. There is also a question as to whether you would want advisors or consultants to become shareholders in the company (or indeed whether they would be keen to do so themselves).

While it is possible to grant options to non-employees, they would not be able to benefit from the EMI regime and it would be extremely important to ensure that the terms of such options are clear as to when and how they would lapse as part of any advisory or consultancy arrangement.

Team members and organisations outside the UK

Direct shareholdings by non-UK team members is not an issue. Grants of options to non-UK employees is possible however they may not be able to enjoy the beneficial tax treatment of such options in the same way as a UK resident employee may do. It would be important to take local advice before deciding to grant options to non-UK residents. For entities that are not incorporated in England and Wales, the laws relating to the jurisdiction of incorporation would apply (albeit we have seen similar structures in a number of jurisdictions).

Conclusion

The employee and team engagement benefits of employee ownership can be considerable and there has been a notable increase in organisations implementing EOTs. While many organisations think about how to best solve immediate concerns around team retention, it is equally important to make sure the structure chosen doesn’t create hurdles for funding or complicate an exit.

What is appropriate for your organisation will depend upon specific circumstances. The team at My Inhouse Lawyer has experience of helping clients implement a variety of structures and can help you consider the benefits of what might be right for you. If you’d like to learn more, please feel free to get in touch.

Written by Oli Cooper

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Want to know more ? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

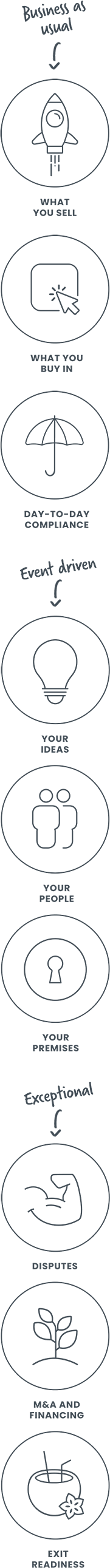

How we can help