Introduction

Whenever the market is down or there is uncertainty or volatility, we tend to see an increase in the number of redundancies being made. This has certainly been the case recently and it’s also true that no matter how much we might wish we could, we can’t save every job. If you are thinking about redundancies within your own business, this article offers some insight.

Redundancy 101

So, what is redundancy? Redundancy is a form of dismissal and is given a legal definition.

Broadly, it will exist if either the business, or the place at which the employee worked, closes down or there is less work available for the employee to do – either now, or at some point in the future. The latter is often overlooked. It means that an employer can ‘look forward’ and, based on future business projections, make employees redundant.

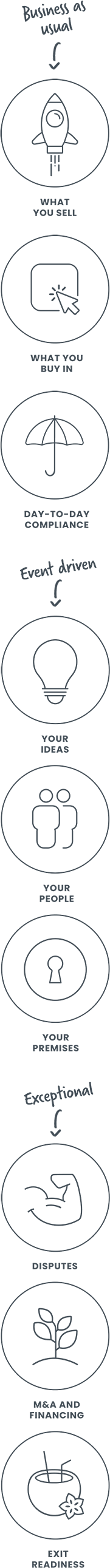

Assuming that the definition is satisfied, an employer must pay a redundant employee a statutory redundancy payment which is calculated according to a legal formula.

![]()

The maximum length of service that can be taken into account is 20 years and the maximum weeks’ pay is capped by law (reviewed each year). Calculation of a weeks’ pay can sometimes be contentious – particularly if part of an employee’s pay includes contractual overtime, tips, commission or bonus payments.

To qualify for a statutory redundancy payment, an employee must have 2 years continuous service with their employer. The 2 year rule is also important as it will mean that the employee has the right not to be unfairly dismissed.

Statutory or Contractual?

Some employers provide contractual redundancy schemes with enhanced payments. If the contractual scheme is more generous than the statutory one, then the contractual scheme will apply. The failure to pay a contractual redundancy payment would be a breach of contract. Difficulties sometimes arise when a redundancy scheme is set out in a Staff Handbook. The question which arises here, is whether the Handbook forms part of the employee’s contract of employment. Some Handbooks explicitly state that it does not – in which case, a closer, legal, analysis will be required as to whether the scheme is, in fact, contractual.

What about notice & other payments?

In addition to a redundancy payment, an employee is entitled to notice. This will normally be set out in the employee’s contract of employment. If not, the employer must give statutory minimum notice, which is calculated on the basis of one week’s notice for each complete year of service, up to a maximum of 12 weeks. An employer cannot give less notice than the statutory minimum. With senior employees, disputes can arise when the contract is silent on notice, but the employee alleges that, because of their senior position, they are entitled to reasonable notice exceeding the statutory minimum. It must be remembered that statutory notice is, simply, the minimum notice to which an employee is entitled.

Notice can either be worked – in which case the employee will continue to attend work and be paid as normal, albeit with reasonable time off to look for alternative employment, or a payment can be made in lieu. In the latter case, the employee’s employment will cease immediately, without their working the notice period and the employee is entitled to receive a payment based on what they would have received had they worked out their notice.

Payments in lieu may, depending on the wording of the contract, be paid tax free up to a limit of £30,000. It is important, however, that the wording is checked by a lawyer.

A payment in lieu may also affect the validity of a restrictive covenant in the employee’s contract. If a payment in lieu is made without a contractual right to do so, this is a breach of contract and restrictive covenants will not normally be enforceable.

A redundant employee must also be paid any accrued holiday pay and be compensated for any loss of contractual benefits over the notice period (such as the loss of use of a company vehicle where it is used for private use and employer pension contributions. In some cases, a dispute may arise as to share options and whether, in a redundancy situation, they can still be exercised by an employee.

What are the risks?

An employee who has more than 2 years’ service can challenge a redundancy dismissal by bringing a claim for unfair dismissal at an Employment Tribunal.

In practice, aggrieved employees often argue that the legal definition of redundancy has not been satisfied and/or that the method of their selection was unfair. The latter is a fertile ground for legal challenge.

For a redundancy dismissal to be fair, an employer must follow a full and proper redundancy consultation procedure. This is a complex area of the law.

In simple terms, however, an employee has to be warned of the risk of redundancy, consideration must be given to alternatives to redundancy (such as an agreed reduction in hours or salary), whether suitable alternative employment exists and, critically, when there is a ‘pool’ of potentially redundant employees, there must be a fair selection from that ‘pool’. The latter should, ideally, be based on a points criteria, wherein employees are allocated points based on objective criteria – such as length of service, disciplinary record etc. The employee(s) with the least amount of points are then selected. To ensure procedural fairness a right of appeal should also be given.

Collective redundancies

If an employer is proposing to dismiss over 20 employees, there are additional requirements to ‘collectively consult’ with employees and their representatives (either employee representatives, elected for that purpose, or a recognised trade union). In addition, the Redundancy Payments Service must be notified before any consultation begins. The failure to collectively consult can result in a fine and Protective Awards for employees. Dismissals may also be unfair.

Conclusion

This is a highly regulated, process-led area of law and it can be easy to be tripped up by technicalities. If you’re embarking on a redundancy programme, the best thing to do is read up as much as you can before doing so. This is a good place to start and there’s plenty of guidance out there for employers. It’s also a good idea to read up on the guidance given to employees so you have both sides of the coin. Next, create a plan. This will ensure you don’t miss out anything essential. Third, it’s always worthwhile thinking about the experience for the person losing their job. Though it’s not a nice experience whichever side of the table you’re sitting on, being a fair, consultative and communicative employer pays dividends in the long run. And finally, if in doubt or inexperienced in this area, get professional help. Getting things right from the outset is far better than being on the back foot defending something done or missed.

Written by Jonathan Waters

Principal & Employment and Dispute Resolution Specialist at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Want to know more ? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

How we can help