Introduction

This environment-facing tax (the PPT) came into force on 1 April.

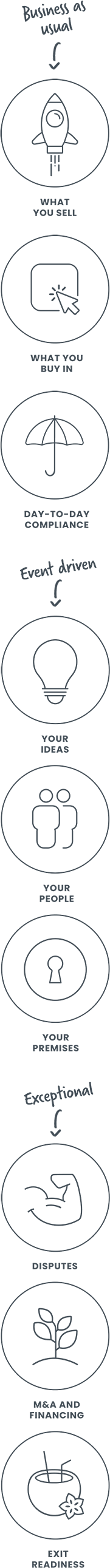

The PPT is of importance to any UK business that either:

- manufactures packaging materials

- imports packaging materials or imports goods with packaging on them, or

- in some circumstances, potentially to any business that receives packaging materials or packaged goods from a UK supplier

The tax itself is on any plastic component of finished packaging (packaging that doesn’t have a further manufacturing process to go through) unless that plastic component is made of at least 30% recycled plastic.

The rate is £200 per metric tonne of chargeable plastic packaging components (and proportionately for part-tonnes).

Fraudulent evasion of the tax risks prison or a fine of up to three times the unpaid tax (or £20,000 if lower).

![]()

Exemptions

Not all plastics are subject to the tax. For example, there is an exemption when the packaged goods are certain medical products or where they are used for long-term storage. Yet even where an exemption applies, the plastic may still count towards the 10-tonne calculation.

There is also a credit/tax cancellation when the packaging is on goods that are intended for export, and that are duly exported within a 12-month statutory period.

There is no express lower threshold for payment of the tax, but there is a registration threshold. Therefore, the “10 tonnes in a year” threshold for registration (see below) operates as a threshold for the tax.

See the government’s guidance for more information on exemptions

Sectors

This tax will affect many UK businesses including those who are themselves in the business of manufacturing packaging as well as those for example, operating in consumer goods, pharmaceuticals, FMCG, cosmetics and online retailers.

So: what do you need to do about this?

Most immediately: the registration question. If you’ve manufactured and/or imported 10 or more tonnes of finished plastic packaging components within the last 12 months (but looking back no further than 1 April 2022), or will do so in the next 30 days, then you must register now for the tax with HMRC.

The tax

As regards the amount to pay (assuming you have had to register), you need to work out whether you need to pay any tax at all (the wrapping for goods from all your overseas suppliers, or what you manufacture, might meet the 30% recycled plastic requirement).

If you think you might need to pay the tax, then you need to be able to calculate (a) how much of each packaging component from a supplier (or which you manufacture) doesn’t meet the 30% recycled test, and then what weight of taxable packaging (the plastic component of the packaging that doesn’t meet the 30% recycled test) comes to you from overseas.

As regards the overseas suppliers, then, you need to do your due diligence and ask for early information from them.

Who pays?

You’re liable to pay this tax if you are a manufacturer of packaging that includes plastic components.

Otherwise, if your supplier is in the UK, then they – or the previous manufacturer – are primarily liable for the tax, not you. But there’s a sting in the tail. If the tax due isn’t paid by the primary taxpayer, then HMRC can impose the liability on you, even if you don’t have to register. You’ll want to consider updating your purchase terms and conditions with appropriate warranties and indemnities. You may also want to think about doing due diligence on your supplier’s wrapping. (If the primary taxpayer does not pay, the risk of your suffering secondary liability imposed is reduced if you’ve done sufficient due diligence).

If your supplier is overseas, then you’re liable for the tax (again, assuming that you’ve had to register). You’ll also want to be thinking about updating your purchase terms and conditions with appropriate warranties as to completeness and accuracy of the information your supplier is giving you – and also what to do about a supplier that doesn’t provide the necessary information, or provides incomplete, inaccurate or insufficient information. Commercially, you’ll also want to be thinking about the price that you sell your goods on to your customers, to allow for the tax.

Record keeping

In all cases you will need to keep records of what information you have about this, to be able to demonstrate compliance to HMRC.

What’s happening elsewhere?

The European Union introduced a plastic packaging levy on member states (as opposed to businesses) at a rate of 800 euros/tonne on 1 January 2021. This will inevitably cascade to businesses. From 2023, Italy and Spain for example are introducing a tax at a rate of 450 euros/tonne on the manufacture or importation of single use plastic.

Conclusion

This is a going to be an ongoing compliance requirement to meet each year. Businesses will need to gear themselves up to be able to assess the amount and type of plastics coming in via their supply chains, make the necessary calculations, file an annual return with HMRC and pay taxes due.

Written by James McLeod

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Want to know more ? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

How we can help