For SME’s that are thinking about raising funds, one of the first things to consider is the type of equity instrument to be offered to new investors. (For fund raising through debt, please see this note written by Stephanie).

Ordinary Shares

The most obvious way to raise equity is through the issue of new shares.

Often, an early-stage SME will have only one single class of ordinary shares meaning all shares carry equal rights on voting, dividends and capital distribution upon a company sale or winding-up.

In this case, issuing new ordinary shares to investors will be the most straightforward way of raising equity, once the value of the company and new shares have been determined and agreed.

There will be some procedural steps that need to be undertaken first including either disapplying the pre-emption rights of existing shareholders to take up new shares or first offering the new shares to existing shareholders at the same price and terms being offered to the new incoming investors.

![]()

Preferred Shares

Where an SME already has a roster of one or more external investors, new investors may wish to invest on the basis of being issued a new preferred class of shares (i.e. Series A, Series B, etc).

Preferred shares will grant the holders a preferential claim over the proceeds of a company sale (or wind-up). The amount per share that preferred shareholders will be entitled to, will be subject to a minimum floor. This will usually be the share price at which the preferred shareholders invested. This minimum share price would need to be paid out first to holders of all preferred shares before any remaining proceeds are distributed to ordinary shareholders.

Where the share price from a company sale (or wind-up) is higher than what the preferred shareholders paid, then the preferred and ordinary shareholders will share the proceeds of a company sale (or wind-up) on an equal basis.

Aside from the sale and liquidation preference as described, preferred shares may additionally have preferred dividend rights which will often accrue at a fixed percentage per annum. The voting rights of preferred shares will typically be on an equal footing to ordinary shares.

Raising equity via the issue of preferred shares usually involves more complexity than issuing ordinary shares. The issue of preferred shares will typically involve amending the company articles and documenting additional rights for the new investors within a shareholders’ agreement.

Convertible Notes

Where an SME wishes to delay having to place a valuation on itself, fund raising via the issue of convertible notes can be a useful alternative.

Convertible notes are a hybrid of debt and equity. The notes will initially work like a debt instrument which accrues interest at a fixed annual rate. However, there is no set timetable for the accrued interest to be serviced. The notes will typically have a fixed maturity date upon which either (a) the principal and accrued interest is repaid, or (b) the notes convert into shares at a predetermined share price. The number of shares to be issued to the noteholders would be the sum of the principal and accrued interest outstanding under the notes divided by the pre-agreed share price.

Prior to the maturity date, convertible notes may also convert into shares upon certain events such as the completion of an equity raise or a company sale where the share valuation exceeds a certain threshold. On an equity raise event, typically the pre-agreed price per share at which the notes can convert will be lower than the share price being paid by the investors on such equity raise.

Prior to conversion, convertible noteholders are not treated as shareholders and have no voting rights. Full shareholder rights will only kick in for the noteholders after the notes convert to equity.

One benefit of convertible notes is that they are usually much simpler and quicker to document compared to the issue of preferred shares although complexity may arise over how to define the pre-agreed or dynamic conversion price of the notes. Pre-emption rights of existing shareholders would also apply to the issue of convertible notes unless these were disapplied.

Advanced Subscription Agreements / Simple Agreements for Future Equity

These two terms are used interchangeably and for ease of reading, we will refer to these instruments collectively as SAFE notes in this article.

SAFE notes are a more “SME friendly” version of convertible notes. Like convertible notes, SAFE notes grant investors the right to receive shares at a future point in time but unlike convertible notes, SAFE’s do not accrue interest and there is no fixed maturity date upon which SAFE’s must either be repaid or convert to equity.

SAFE notes will convert into shares upon certain trigger points. Typically, this is a subsequent equity funding round meeting a pre-agreed monetary threshold. Usually, the conversion price of a SAFE note will be capped at the lower of a pre-agreed level and the equity round price. Sometimes a discount is also applied to the equity round price to further reduce the conversion price.

In theory, if no conversion trigger event occurs, the SAFE notes can continue indefinitely in the background. However SAFE noteholders will be entitled to share in any dividends that are declared by the company.

Well-established templates for SAFE agreements are publicly available and this means SAFE notes are generally simpler and quicker to agree compared to convertible notes.

Conclusion

The above provides a very brief snapshot of different types of equity raising instruments. Whichever route is taken will largely depend on the relative bargaining power between an SME and its potential investors, as well as the current growth stage of the SME.

Written by Dan Chu

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Want to know more ? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

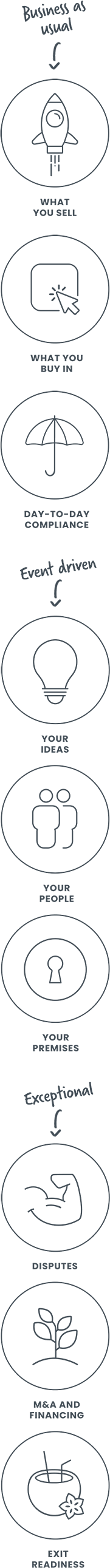

How we can help