Introduction

The CEO of Widget Limited (‘Widget’) has a problem. A few months ago Widget sold 1000 pallets of (you guessed it) widgets to one of its regular customers, Credit Risk plc. Checking his latest list of aged debts, our CEO can see that Credit Risk has yet to pay a penny of what is owed for the widgets.

Sitting nervously in front of the CEO is Widget’s finance manager. What’s the concern? You are ahead of me: he didn’t include a retention of title (ROT) clause in the sale contract with Credit Risk.

![]()

There is a common adage that possession is nine-tenths of the law, but there are practical legal mechanisms that can help. One example is a retention of title (ROT) clause. The purpose of an ROT clause is to (attempt to) protect a seller’s title to the goods it sells, so that if a buyer fails to pay for those goods, the seller still owns the goods which were the subject of the transaction. In other words, ownership (title) of the goods only passes to the buyer, once the buyer has paid for the goods in full. Using such a clause could well have protected Widget’s position.

A basic ROT clause

A basic ROT clause provides that the seller retains title to goods until it has received full payment for them. Other provisions are typically included alongside the ROT clause, such as:

- A right for the seller to repossess the goods on the occurrence of a specific event, most obviously, non-payment

- A right to prevent the buyer from selling or using the goods until they’ve been paid for

- A right for the seller to enter the buyer’s premises in order to repossess the goods

- An obligation on the buyer to insure the goods upon delivery and to note the seller’s interest on the buyer’s insurance policy, store the seller’s goods separately from other goods belonging to other third parties, mark the goods as the seller’s property, and allow the seller access to the buyer’s premises to verify that this has been done

- If the goods supplied are to be attached or annexed to the buyer’s premises (e.g. heavy plant or machinery), the buyer will often be prohibited from doing this without the seller’s prior consent. This makes sense because, otherwise, if goods do become annexed to premises, the seller would need the consent of the owner of those premises before it can repossess the goods. Sometimes the owner of the premises is a 3rd party and sometimes it’s the buyer itself which would produce an awkward loop where the seller would need the buyer’s permission to repossess the very goods which the buyer has failed to pay for

Strengthening an ROT clause

Here are three ways to bolster an ROT clause: (i) ‘all-monies’, (ii) ‘proceeds of sale’ and (iii) mixed goods clauses.

An ‘all-monies’ clause takes a catch-all approach to ROT. In this case, the seller retains ownership of the goods supplied until the buyer has paid not only for those particular goods, but also for any other goods supplied by the seller to the buyer.

Whilst such a clause is helpful where a seller deals with a buyer on multiple occasions, there is a risk that an all-monies clause creates a charge by the buyer in favour of the seller, which would be void against any liquidator or administrator, unless that charge is registered at Companies House (which can be difficult to do).

An all-monies clause should always therefore be made ‘severable’ to avoid the whole ROT clause being held to be void.

Another way to bolster an ROT clause is known as a ‘proceeds of sale’ clause. This enables the seller to assert rights in the proceeds of sale to satisfy the purchase price of the goods. There is a high risk that such a clause will be found to be a charge, giving rise to the same problems as noted above.

A basic retention of title clause may not be enough where goods are to be integrated into a manufacturing process as they’ll lose their identity. In this case, a ‘mixed goods clause’ is sometimes added to a basic retention of title clause to enable the seller to assert rights of ownership in any new product resulting from the manufacturing process. However, the Courts have held that any retention of title clause which gives a seller rights over new goods will create a charge which will be ineffective if not registered and registration can be difficult (as noted above).

Sellers of products that are used within a manufacturing process should therefore consider other means of securing their purchase price, such as credit insurance.

What are the advantages of ROT clauses?

There are lots of benefits to including an ROT clause including:

- Enhancing bargaining power: when the buyer knows that ownership of the goods remains with the seller, there is an added incentive to pay for those goods promptly or face the risk of goods being reclaimed

- Flexibility in structuring commercial agreements: ROT clauses offer flexibility, allowing sellers to protect their financial interests but still allow buyers to operate with a degree of freedom (e.g., through proceeds of sale clauses). Such structures help maintain good buyer/seller relationships whilst protecting the seller’s financial position

- Security in the event of insolvency: an ROT clause provides a form of security to the seller in the event that the buyer becomes insolvent before paying for goods. In such cases, the seller can usually reclaim the goods that have not yet been paid for which avoids having to wait at the back of the queue as an unsecured creditor

What are the risks?

While ROT clauses will provide some protection, there are some risks to consider:

- Administrative burden: The use of ROT clauses can create an administrative burden for the seller, who must keep track of which goods have been paid for and which have not

- Reputation risk: A seller who frequently invokes an ROT clause may obtain an unwanted reputation in its market with equally unwanted commercial downsides

- Insolvency of the Buyer: In the event of the buyer’s insolvency, the application of ROT clauses can become complex. The seller may face difficulties in recovering the goods, especially if they have been mixed with other goods or sold to third parties

- Enforceability: If the clause is not properly drafted or incorporated into the contract, it may not be enforceable

- Legal costs: If a dispute arises over an ROT clause, the seller may incur significant legal costs in enforcing their rights

- Legal changes: the law has evolved quite frequently regarding ROT clauses, so it’s important to keep abreast of the most recent position

Alternatives to ROT clauses

Sellers should also consider other methods of credit control to work alongside ROT clauses. Some options are:

- Reducing any period of credit allowed to the buyer, or the amount of credit, or both

- Taking alternative forms of security, such as a bank guarantee

- Obtaining credit insurance

- Requiring some form of deposit or payment upfront before the goods are supplied

Conclusion

So, as we leave our finance manager studying the small print of his P45, what conclusions can we draw? ROT clauses are a valuable tool for sellers to mitigate risk in the sale of goods. However, their enforceability can be complex and uncertain. It’s crucial to draft these clauses carefully and seek legal advice when using them.

Please feel free to get in touch if you’d like to know more

Written by Rich Hinchliffe

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Want to know more ? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

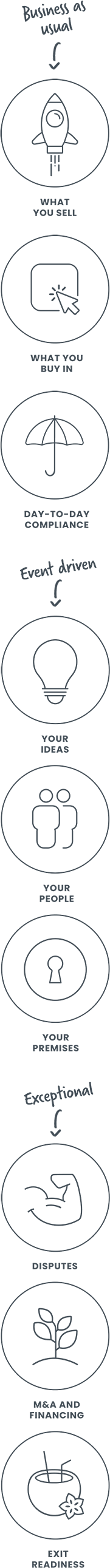

How we can help