Introduction

My Inhouse Lawyer’s employment law specialist, Jonathan Waters, highlights some of the ‘must know’ updates to employment law.

-

Statutory Payments

It’s that time of the year when the annual increases to various statutory compensation limits are announced. Some of the more important changes are as follows:

With effect from 6 April 2021, the following have been increased:

The maximum amount of a week’s pay, used for the calculation of a statutory redundancy payment, is increased to £544 per week.

The maximum compensatory award for unfair dismissals, where the dismissal is on, or after, 6 April 2021 is increased to £89,493.

The weekly rates for statutory maternity, paternity, adoption and shared parental leave are increased to £151.97 and the weekly rate of SSP to £96.35.

The ‘headline’ National Minimum Wage for those aged 23 or over has increased to £8.91.

-

Gender Pay Reporting

Following on from the subject of money, private sector employers with 250 or more employees are legally required to publish information about differences in pay and bonuses as between their male and female employees.

The deadline for publication is normally 4 April for private sector employers.

However, due to Coronavirus, the Equality and Human Rights Commission has recently announced that the reporting duty for 2020/2021 will be delayed by 6 months to 5 October 2021.

Please note, that this does not excuse a business from reporting – it simply delays it by 6 months.

-

IR35

Reforms to IR35 for the private sector came into force on 6 April 2021, having been delayed due to Coronavirus.

Under the rules, a business which engages a contractor is responsible for determining their employment status and assessing whether IR35 applies. If it does, there will be tax implications across the supply chain including for the deemed employer and contractor.

Determining a contractor’s ‘true’ legal status is not an easy task, although many on-line tools are available.

To ensure IR35 compliance, it is important that ‘contractor contracts’ are carefully checked.

Not all businesses will be caught by IR35 and there is for example, an exemption for those businesses which fall within the definition of a ‘small company’ – namely, a company which meets 2 of the following 3 conditions: less than 50 employees, an annual turnover of less than £10.2m and a balance sheet of less than £5.1m.

-

Employment Status

IR35 brings me to the subject of employment status – is an individual an employee, worker or a self- employed contractor?

This is an important question. Employees enjoy a raft of employment protection rights, whilst workers have less and self-employed contractors none.

This was a subject that the Supreme Court had to grapple with recently in a highly publicised case involving Uber drivers.

On the facts of this case (and cases involving employment status will, inevitably, be fact specific), the Court held that Uber drivers were workers and were working when their app was switched on and they were ready and willing to accept a booking.

As a consequence, the drivers were entitled, as workers, to certain statutory employment rights, including holiday pay and the National Minimum Wage.

The Court noted that the determination of an individual’s status was not based on what had been agreed in the contract, but on a detailed evaluation of the working relationship as a whole.

Each case will, as noted, turn on its own particular facts. However, given the trend towards outsourcing, coupled with the risks associated around IR35, it would be wise to revisit relevant contracts.

-

Immigration and Brexit

Brexit seems a long forgotten word now!

With the coming of Brexit, ‘Freedom of Movement’ has now come to an end.

From 1 January 2021, anyone from outside of the UK and Ireland wishing to work in the UK will require a visa. This includes individuals from the EU. The Government has implemented a points based immigration system which individuals must satisfy.

If an employer wishes to recruit from ‘overseas’, then a sponsorship licence will have to be obtained from the Home Office. The process can take, on average, 8 weeks, sometimes longer.

Those individuals who are EU nationals who started leaving in the UK prior to 31 December 2020 can apply for either settled or pre settled status, which, depending on their individual circumstances, will allow them to remain in the UK.

Written by Jonathan Waters

Principal & Employment and Dispute Resolution Specialist at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Like what you see? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

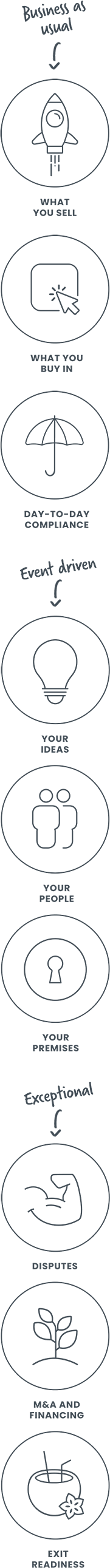

How we can help