Introduction

Preparing for an exit is often a very daunting prospect for many business owners. For SME’s, this can have the added complexity of family ownership structures and often close personal relationships within the management teams which can make the process emotionally challenging!

Whilst external factors may drive the timetable, preparation and a strategic approach will be the key to success. Many businesses discover that they are not “sale ready” when under the spotlight of a buyer’s due diligence which can undermine a seller’s negotiating position.

We explore some practical steps to prepare the business for a potential sale.

![]()

Planning for an exit

Give yourself time to plan. It is sensible to plan for a potential sale as part of a 3-year plan to enable you to assemble the right professional team, present a strong proposition and approach the market on the front foot. An important question to ask is – what would a buyer want to see when considering purchasing my business? Often a buyer will look for:

- A sustainable position in the market with potential for growth

- Solid customer base with demonstrable “goodwill”

- A realistic and achievable business plan

- A committed management team

- Excellent corporate governance

Appointing the team

The appointment of advisors, lawyers, accountants and other specialists, who have a demonstrable track record in delivering the type of transaction you are seeking is a good early step. It is important that those advisors are given the opportunity to get to know your business and understand your strategic goals so that early actions can be taken, particularly in relation to tax and other financial planning and business structures before going to market.

Valuation

The X million-dollar question is: What is the value of the business and what level of price is it likely to achieve in the market. There is often a disparity between the two which can lead to abortive negotiations. It is important to engage a corporate finance specialist to assess the “true” value of the business which should also identify how to emphasise the value drivers to maximise the market price.

Buyers are increasingly seeking to share the risk on future trading through deferred consideration and “earn outs” so that both buyer and seller have some “skin in the game”. This is an area that requires careful consideration and security measures to protect a seller where there are significant payments due in the future.

Protect the key assets

The management team and key employees will have been fundamental to the success of the business, its inherent value and its future potential. Being able to secure the team will often be crucial for a buyer. Early consideration of share option schemes and incentivisation measures can ensure that their interests are aligned with the businesses long term goals. The loss of key personnel can break the deal or reduce value.

Early due diligence process

As with selling a house, it is often first impressions that count. The look and feel of a business operation, its professionalism and administration are often critical in a buyer proceeding with serious negotiations and entering a due diligence exercise.

As with any commercial negotiation, the buyer’s advisors will be seeking to uncover any risk in the business operation with consequent effect on price. One way of pre-empting such issues, is to undertake a seller’s due diligence exercise where the professional advisors can provide a due diligence report on the financial and legal “health” of the business and identify actions that may be taken to mitigate any issues outside the heat of the sale process. In addition, this can be provided to the buyer to potentially reduce the scope of its own due diligence exercise.

Legal health – key considerations?

- Contracts – Are all key contracts up-to-date and available and all commercial arrangements formalised by way of written agreements?

- Financial reports and company Records -are these all up to date and readily available? Are they in a format that would be expected by a buyer’s professional advisors?

- Employment contracts – Are robust employment contracts in place with necessary restrictions around non-solicitation of customers and staff, non -competition and ownership of intellectual property?

- Data protection – is the business compliant with data protection legislation? Is there a clear sense of what data is being processed, why, where and by whom? Are the right privacy notices, policies and data processing agreements in place? And are there data flows outside the EEA?

- Property documents – are title documents available and do they provide all necessary rights? Are there any potential restrictions on assignment, alteration etc that may impact upon future use and value?

- Intellectual property rights – IPR is often a significant asset of the business. Are these adequately protected through registration, and can ownership be clearly demonstrated?

- Licences and regulatory permissions – these are often fundamental to the operation of the business. Are change of control provisions that require consent for any change of ownership?

- Policies and procedures – are necessary policies and procedures in place and up to date? Are anti-money laundering, health and safety protocols industry standard?

- Disputes – are there any pending issues that may be discovered on due diligence? Can these be resolved by way of commercial settlement.

All the above issues, will be explored and stress-tested during the due diligence process and the advantages of considering and (where necessary) addressing these issues at an early stage are as follows:

- Allows sufficient time to deal properly with any omissions or deficiencies

- Avoids loss of buyer confidence and pricing pressure being applied during the sale process

- Enables the professional advisors an early understanding of risk and necessary mitigations

- Allows for the preparation of an accurate Information Memorandum

- The establishment of a comprehensive data room which will accelerate any buyer due diligence process

In conclusion

It’s all in the planning. Early and detailed preparation is key to a successful business sale. With the right legal and financial advisers by your side, you can stress-test a transaction and pre-empt, and mitigate against key risk before the buyer teams gets involved

Written by Charlie Tomlinson

Principal at My Inhouse Lawyer

One of our values (Growth) is, in many ways, all about cultivating a growth mindset. We are passionate about learning, improving and evolving. We learn from each other, use the best know-how tools in the market and constantly look for ways to simplify. Lawskool is our way of sharing with you. It isn’t intended to be legal advice, rather to enlighten you to make smart business decisions day to day with the benefit of some of our insight. We hope you enjoy the experience. There are some really good ideas and tips coming from some of the best inhouse lawyers. Easy to read and practical. If there’s something you’d like us to write about or some feedback you wish to share, feel free to drop us a note. Equally, if it’s legal advice you’re after, then just give us a call on 0207 939 3959.

Want to know more ? Book a discovery call

How it works

1

You

It starts with a conversation about you. What you want and the experience you’re looking for

2

Us

We design something that works for you whether it’s monthly, flex, solo, multi-team or includes legal tech

3

Together

We use Workplans to map out the work to be done and when. We are responsive and transparent

Like to know more? Book a discovery call

Freedom to choose & change

MONTHLY

A responsive inhouse experience delivered via a rolling monthly engagement that can be scaled up or down by you. Monthly Workplans capture scope, timings and budget for transparency and control

FLEX

A more reactive yet still responsive inhouse experience for legal and compliance needs as they arise. Our Workplans capture scope, timings and budget putting you in control

PROJECT

For those one-off projects such as M&A or compliance yet delivered the My Inhouse Lawyer way. We agree scope, timings and budget before each piece of work begins

Ready to get started? Book a discovery call

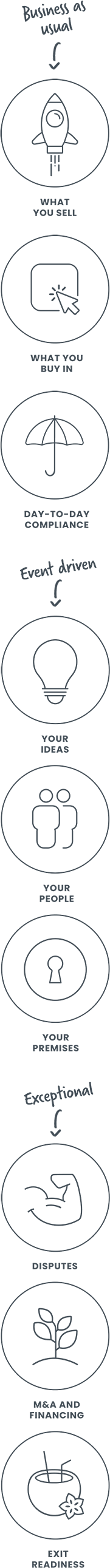

How we can help